s corp tax calculator nyc

New York Permits and Licenses. Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022.

Llc Tax Calculator Definitive Small Business Tax Estimator

Enter your estimated annual business net income and the reasonable salary you will pay yourself as an S Corporation employee to.

. Now if 50 of those 75 in expenses was related to meals and. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. This is why it is imperative for those considering an S-corp to be.

Forming an S-corporation can help save taxes. See TSB-M-15 7C 6I for additional information on the impact of corporate tax reform on New York S corporations and their shareholders. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes.

S-Corp or LLC making 2553 election. Essex Ct Pizza Restaurants. From the authors of Limited Liability Companies for Dummies.

The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800. We are not the biggest firm but we will work with you hand-in-hand. This could potentially increase the S-corp tax bill significantly and essentially wipe out the other tax advantages offered by this entity structure.

Smaller businesses with less net income will only have to pay 65. Check each option youd like to calculate for. Learn about standard filing costs here for NY corporations.

Start Using MyCorporations S Corporation Tax Savings Calculator. New York Estate Tax. See S corporations - tax years beginning before January 1 2015 for S corporation information for years prior to corporate tax reform.

The exemption for the 2021 tax year is 593 million which means that any. Rate in Tax Year 2015 and thereafter. S Corp Tax Savings Discover possible tax savings by comparing S Corp to LLCs in your state.

A fee every other year when you file your biennial report. Our S corp tax calculator will estimate whether electing an S corp will result in a tax. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax.

What percent of equity do you own. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. Use this calculator to get started and uncover the tax savings youll receive as an S Corporation.

Being Taxed as an S-Corp Versus LLC. New Yorks estate tax is based on a graduated rate scale with tax rates increasing from 5 to 16 as the value of the estate grows. Our calculator will.

If your shareholders have made an S election for federal purposes you. Llc S Corp Tax Calculator. S corp tax calculator nyc Thursday February 10 2022 Edit.

The portion of total business capital directly attributable to stock in a subsidiary that is taxable as a utility within the meaning of the New York City Utility Tax or would have been taxable as an insurance corporation under the former New York City. Electing S corp status allows LLC owners to be taxed as employees of the business. Opry Mills Breakfast Restaurants.

Lets start significantly lowering your tax bill now. Cooperative housing corporations 04. New York State Biennial Report Fee.

For taxpayers in the state of new york theres new york city and then theres everywhere else. When taxing capital the rate is 015 with a cap payment of 1 million. This offers you an estimate for your business net income for the year to use in our s corp tax savings calculator.

Another way that corporations can be taxed is directly on their business capital less certain liabilities. These corporations will continue to file GCT tax returns in tax years beginning on or after January 1 2015 if they are. This allows owners to pay less in self-employment taxes and contribute pre-tax dollars to 401k and health insurance premiums.

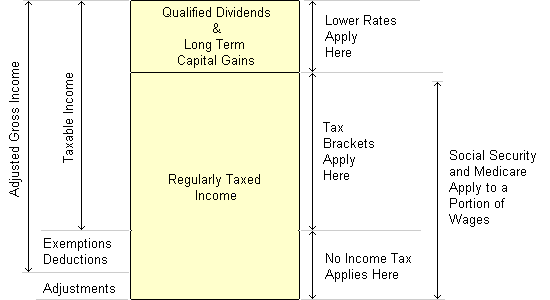

Partnership Sole Proprietorship LLC. Entire net income base 885 percent of. Income Tax Rate Indonesia.

Soldier For Life Fort Campbell. This guide will quickly teach you the major mechanics of how your taxes and this tax calculator work how we calculated your tax rate and where you can start saving. Normally these taxes are withheld by your employer.

For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125. Common Fees for a New York Corporation. New york state voluntary contributions.

However one major difference from c corporations is that the new york city s corporation tax rate is a flat 885as opposed to a range of 65 to 885. Fees for forming a corporation in New York. However if you elect to be taxed as an S-Corporation and take a 40000 salary with the remaining 30000 being a distribution to you or you keep it in the business you pay only.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp. SmartAssets New York paycheck calculator shows your hourly and salary income after federal state and local taxes. C-Corp or LLC making 8832 election.

Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the US. New York Citys income tax system is also progressive and rates range from 3078 to 3876. If you are a qualifying manufacturer you will have a cap of 350000.

This calculator helps you estimate your potential savings. In order to gain New York tax-exempt status a corporation must qualify as a 501c and obtain a Nonprofit Tax-Exempt ID Number from the IRS. Now if 50 of those 75 in expenses was related to meals and.

S Corp Tax Calculator - S Corp vs LLC Savings. Enter your info to see your take home pay. New York City Taxes A Quick Primer For Businesses O8u8mfhr3kscom S Corp Tax Calculator Llc Vs C Corp Vs S.

Delivery Spanish Fork Restaurants. S corp vs llc tax savings calculator. All other corporations 15.

Restaurants In Matthews Nc That Deliver. New York may also require nonprofits to file additional paperwork with the New York Department of Revenue to gain exemption from New Yorks corporate taxes. If your business is incorporated in New York State or does business or participates in certain other activities in New York State you may have to file an annual New York State corporation tax return to pay a.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Use our detailed calculator to determine how much you could save. As the Big Apple imposes its own local income tax on top of the state one.

Free Broadband For 5 Nyc Housing Developments New York Rent Being A Landlord Nyc Real Estate

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

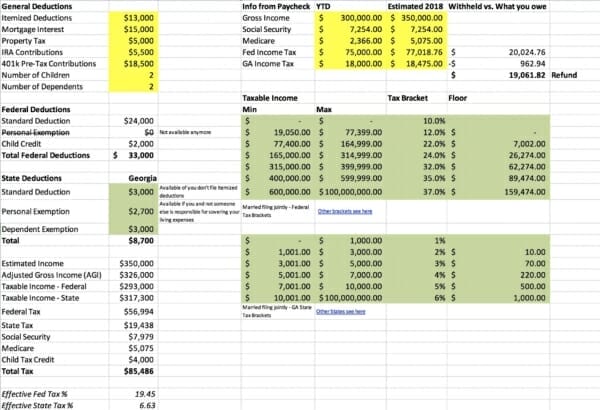

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Llc Tax Calculator Definitive Small Business Tax Estimator

How Much To Set Aside For Small Business Taxes Bench Accounting

Hapur Business Card Business Card Template Design Business Cards Creative Templates Business Cards Creative

You Can Rely Upon Our Professional Expertise Small Business Funding Stock Market Business Funding

What Is The Llc Tax Rate In New York Gouchev Law

Capital Gains Tax Calculator 2022 Casaplorer

The Donotpay App Is The Home Of The World S First Robot Lawyer Fight Corporations Beat Bureaucracy And Sue Anyone At The Press Of A First World Fight Lawyer

Interview With Graphic Designer Rafael Esquer Of Alfalfa Studio I Love Ny Graphic Design Logo

State Corporate Income Tax Rates And Brackets Tax Foundation

Free Credit Dispute Letters Credit Repair Secrets Exposed Here Credit Repair Letters Credit Repair Business Credit Dispute

New York State Pass Through Entity Tax Sciarabba Walker Co Llp

Chinese Microsoft Windows 8 Consumer Preview Screenshots Leak Microsoft Microsoft Windows Windows